What is Saving Account?

HDFC Zero Balance Savings Account A savings account is a type of bank account that is designed to help individuals and organizations save money while earning interest on their deposited funds. It is one of the most basic and common types of bank accounts available.

Read also –Paytm SBI Credit card

When you open a savings account, you deposit money into the account, and the bank pays you interest on the balance. HDFC Zero Balance Savings Account The interest rate may vary depending on the bank and prevailing market rates. HDFC Zero Balance Savings Account The interest earned on a savings account is typically lower than what you might earn from other types of investments, such as stocks or bonds, but it provides a secure and accessible way to store your money.

One of the key features of a savings account is that it allows you to withdraw your money whenever you need it, providing liquidity. HDFC Zero Balance Savings Account However, there may be certain limitations on the number of withdrawals or transactions you can make within a given period, usually to encourage saving habits rather than constant spending.

Savings accounts are often used for short-term financial goals or as an emergency fund to cover unexpected expenses. They are considered low-risk because the funds deposited are typically insured by government-backed programs, HDFC Zero Balance Savings Account such as the Federal Deposit Insurance Corporation (FDIC) in the United States, up to a certain limit, providing a level of protection for your savings.

It’s important to note that different banks may offer various features and terms for their savings accounts, such as minimum balance requirements, fees, and additional benefits. It’s advisable to compare different options before opening a savings account to ensure it meets your specific needs and preferences.

How to Open Zero Balance Account in HDFC?

we can provide you with general information on how to open a zero balance account in HDFC Bank. HDFC Zero Balance Savings Account However, please note that bank policies and procedures may change over time, so it’s always a good idea to contact HDFC directly or visit their official website for the most up-to-date information. Here are the general steps you can follow:

Read also –CSC Registration 2023

- Visit the HDFC Bank website or any nearest HDFC Bank branch to inquire about the zero balance account options available. HDFC Zero Balance Savings Account You can also check if there are any specific eligibility criteria or documents required.

- Gather the necessary documents: Typically, HDFC Zero Balance Savings Account you will need to provide documents such as proof of identity (PAN card, Aadhaar card, passport, etc.), proof of address (utility bill, Aadhaar card, driving license, etc.), and passport-sized photographs.

- Visit the HDFC Bank branch closest to you and ask to speak with a bank representative who can guide you through the account opening process.

- Fill out the account opening form: HDFC Zero Balance Savings AccountThe bank representative will provide you with an account opening form. Fill in all the required information accurately and completely. Make sure to specify that you want to open a zero balance account.

- Submit the required documents: HDFC Zero Balance Savings Account Attach the necessary documents along with the account opening form. The bank representative will verify the documents and return the originals to you.

- Provide any additional information: The bank may ask you for additional information or documents, depending on their requirements and your specific circumstances.

- Complete the KYC (Know Your Customer) process: You will be required to undergo a KYC process, which may involve biometric verification (fingerprint or iris scan) and providing your photograph.

- Signature verification: You may be asked to provide your signature for verification purposes. HDFC Zero Balance Savings Account This can be done at the bank branch in the presence of a bank official.

- Account activation: Once all the necessary steps are completed and your application is approved, HDFC Zero Balance Savings Account the bank will activate your zero balance account. You will receive your account details, such as the account number and debit card, either immediately or within a few days.

Read also –How to Open tide business account

HDFC Zero Balance Savings Account It’s important to note that certain zero balance accounts may have certain limitations or conditions, such as a limit on the number of transactions or a minimum balance requirement after a specified period. HDFC Zero Balance Savings Account Therefore, it’s advisable to inquire about the specific terms and conditions associated with the zero balance account you wish to open with HDFC Bank

HDFC Saving Account Benefit?

Opening a savings account with HDFC Bank in India offers several benefits. Here are some of the key advantages of having an HDFC savings account:

- Interest on Savings: HDFC Bank provides competitive interest rates on savings account balances, HDFC Zero Balance Savings Account allowing your money to grow over time.

- Wide Branch and ATM Network: HDFC Bank has an extensive branch and ATM network across India, making it convenient for you to access your funds and perform banking transactions.

- Online Banking: HDFC Zero Balance Savings Account HDFC offers comprehensive online banking services, allowing you to manage your account, transfer funds, pay bills, and access a range of other banking services from the comfort of your home or office.

- Mobile Banking: HDFC’s mobile banking app enables you to carry out various banking activities on your smartphone, including balance inquiries, fund transfers, HDFC Zero Balance Savings Account bill payments, and more.

- Debit Card: HDFC Zero Balance Savings Account Upon opening an HDFC savings account, you will receive a debit card that can be used for ATM withdrawals, online purchases, and point-of-sale transactions.

- Multi-Channel Banking: HDFC Bank provides multiple channels for banking, including phone banking and SMS banking, HDFC Zero Balance Savings Account offering you convenient options to access your account and perform transactions.

- Sweep-in Facility: HDFC offers a sweep-in facility that automatically transfers surplus funds from your savings account to a fixed deposit to earn higher interest rates. This facility ensures that your idle money is working for you.

- Easy Money Transfers: With HDFC Bank, you can easily transfer funds to other accounts within the bank, as well as make interbank transfers using services like NEFT, RTGS, and IMPS.

- Insurance and Investment Options: HDFC Zero Balance Savings Account HDFC savings account holders may have access to a range of insurance and investment products, such as life insurance, mutual funds, fixed deposits, and more.

- Special Offers: HDFC occasionally provides special offers and discounts on various services, including travel, shopping, dining, and entertainment, for its account holders.

It’s important to note that specific benefits and features may vary based on the type of savings account you choose and any promotional offers available at the time of account opening. HDFC Zero Balance Savings Account It’s advisable to visit HDFC Bank’s official website or contact their customer service for the most up-to-date and accurate information regarding savings account benefits.

How to Open HDFC Bank Account in Online?

To open an HDFC Bank account online, you can follow the steps below:

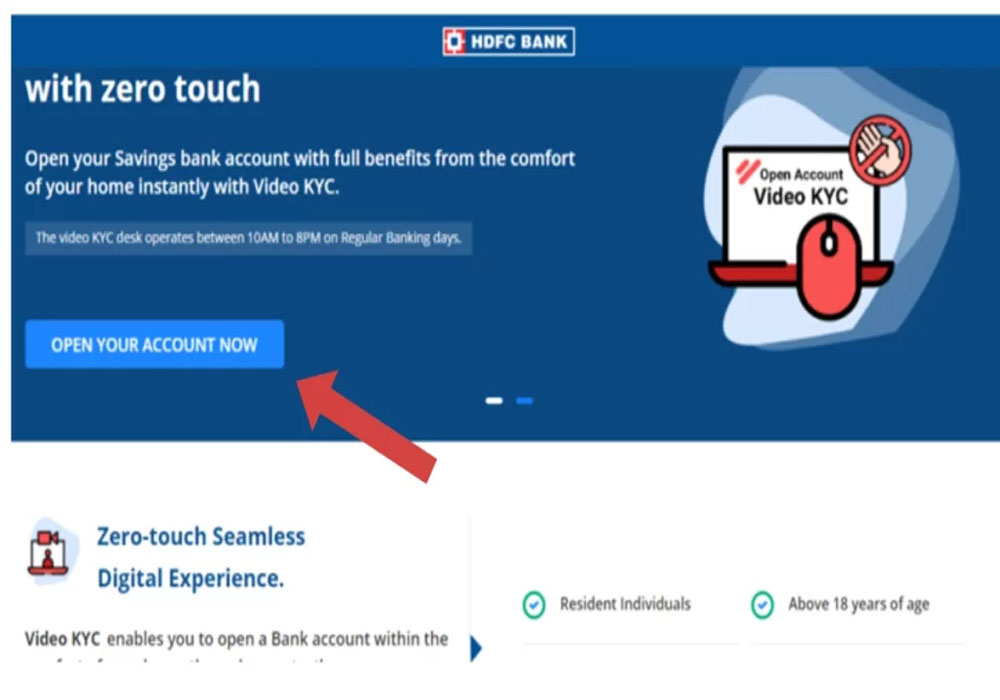

- Visit the HDFC Bank website: HDFC Zero Balance Savings Account Go to the official website of HDFC Bank using a web browser.

- Navigate to the account opening section: Look for the “Open an Account” or “Apply Now” option on the website’s homepage. Click on it to proceed.

- Choose the type of account: HDFC Bank offers various types of accounts, such as savings accounts, current accounts, and salary accounts. Select the type of account you wish to open.

- Fill in the application form: Provide the required information in the online application form. This typically includes personal details like your name, address, date of birth, contact information, and occupation. Make sure to enter accurate and up-to-date information.

- Select additional services: HDFC Bank offers additional services like internet banking, debit cards, and mobile banking. Choose the services you want to avail of and proceed.

- Upload necessary documents: As part of the account opening process, you’ll need to submit certain documents. These generally include proof of identity (PAN card, Aadhaar card, passport, etc.), proof of address (utility bills, ration card, rental agreement, etc.), and a passport-size photograph. Scan or take clear photos of these documents and upload them as per the instructions provided.

- Review the application: Double-check all the entered information and uploaded documents to ensure accuracy. Review the terms and conditions of the account opening.

- Submit the application: Once you are satisfied with the details, submit the application form online.

- Verification and confirmation: After submitting the application, HDFC Bank will verify the provided information and documents. They may contact you for any additional information or clarification if required.

- Account activation: Once your application is approved, HDFC Bank will provide you with the account details, such as the account number and customer ID. They will also guide you on the next steps to activate your account, which may include visiting a branch or completing the KYC (Know Your Customer) process.

It’s worth noting that the exact process and requirements may vary over time or based on your location. It’s recommended to visit the HDFC Bank website or contact their customer support for the most up-to-date and accurate information regarding online account opening procedures.

Comparison of HDFC Bank Account to Others Bank Account –

When comparing HDFC Bank accounts to accounts offered by other banks, there are several factors to consider. Here are some points to help you compare HDFC Bank accounts with accounts from other banks:

- Account Types and Features: HDFC Bank offers a range of account types, such as savings accounts, current accounts, and salary accounts. Other banks may offer similar account types, but the specific features and benefits may vary. Compare the interest rates, minimum balance requirements, ATM/debit card facilities, online/mobile banking services, and any additional features provided by each bank.

- Branch and ATM Network: Consider the size and accessibility of the bank’s branch and ATM network. HDFC Bank has a widespread network of branches and ATMs across India, but other banks may have different coverage. Evaluate the convenience of accessing branches and ATMs based on your location and requirements.

- Fees and Charges: Compare the fees and charges associated with maintaining an account at HDFC Bank and other banks. Look for charges related to account opening, minimum balance non-maintenance, ATM withdrawals, fund transfers, checkbooks, and other banking transactions. Evaluate which bank offers the most cost-effective account for your needs.

- Customer Service: Assess the quality of customer service provided by HDFC Bank and other banks. Look for reviews and ratings regarding their responsiveness, problem resolution, and overall customer experience. Prompt and reliable customer service can significantly impact your banking experience.

- Additional Services: Consider any additional services provided by the bank, such as investment options, loans, credit cards, insurance products, and specialized banking services. Evaluate the availability, terms, and conditions of these services and compare them across different banks.

- Reputation and Trust: Evaluate the reputation and trustworthiness of HDFC Bank and other banks. Look for factors such as the bank’s history, financial stability, customer satisfaction, and regulatory compliance. Opting for a bank with a strong reputation can provide peace of mind and assurance.

- Personal Preferences: Finally, consider your personal preferences and priorities. Are you looking for a bank with extensive online banking capabilities, mobile app features, or specific account perks? Assess how well each bank aligns with your requirements and preferences.

It’s important to research and compare the specific offerings, terms, and conditions of different banks to make an informed decision based on your individual banking needs and priorities.

High Networth Banking of HDFC?

HDFC Bank offers high net worth banking services for individuals with substantial financial resources. These services are designed to cater to the specific needs and preferences of high net worth individuals (HNIs) by providing personalized banking solutions and a range of exclusive benefits.

Some of the key features and benefits of HDFC Bank’s high net worth banking services include:

- Dedicated Relationship Manager: HNIs are assigned a dedicated relationship manager who serves as a single point of contact for all their banking needs. The relationship manager provides personalized assistance and advice on various financial matters.

- Priority Service: High net worth banking customers receive priority service at branches, call centers, and other touchpoints. This ensures quicker response times and efficient resolution of queries or requests.

- Premium Banking Products: HDFC Bank offers a wide range of premium banking products tailored for HNIs, including customized savings and current accounts, high-value fixed deposits, specialized investment options, and exclusive credit cards with enhanced benefits.

- Wealth Management Services: HDFC Bank provides comprehensive wealth management services, including portfolio advisory, investment planning, insurance solutions, estate planning, and tax advisory services. These services are aimed at helping HNIs grow and manage their wealth effectively.

- Exclusive Privileges and Offers: High net worth banking customers often enjoy exclusive privileges and offers, such as preferential interest rates, discounted fees on various banking services, access to premium lounges at airports, lifestyle benefits, and invitations to exclusive events.

To avail of HDFC Bank’s high net worth banking services, you may need to meet certain eligibility criteria, which usually include maintaining a minimum average quarterly balance or having a specific net worth threshold. It is recommended to reach out to HDFC Bank directly or visit their official website for detailed information on the specific requirements and benefits associated with their high net worth banking offerings.