Why and what will happen if you don’t link Aadhar card with PAN card?

The Indian government has made it mandatory to link Aadhaar card with PAN card for most taxpayers. This move was aimed at reducing tax evasion and creating a more streamlined tax system.

If you do not Income tax PAN Aadhaar link Easily, it may lead to consequences such as:

- Inability to file income tax returns: If your Aadhaar card is not linked with your PAN card, you may not be able to file your income tax returns, which could result in penalties and legal repercussions.

- Invalidation of PAN card: If you fail toIncome tax PAN Aadhaar link Easily, your PAN card may be declared invalid, making it difficult for you to carry out financial transactions.

- Delay in receiving tax refunds: If you do not link your Aadhaar card with your PAN card, it may lead to a delay in receiving tax refunds.

It is therefore advisable to Income tax PAN Aadhaar link Easily to avoid any such issues.

Read Also: – Plus Subscription of chat Gpt now available in India 2023

Merits of PAN Aadhaar link in future Reference.

Linking PAN card with Aadhaar card has several benefits in future reference, including:

- Eliminating duplicate PAN cards: Linking PAN with Aadhaar helps eliminate the issuance of duplicate PAN cards, which can help prevent tax fraud and reduce administrative costs.

- Easy and seamless tax filing: The PAN Aadhaar link enables easy and seamless filing of income tax returns. With this link, taxpayers can file their income tax returns using Aadhaar authentication instead of the traditional method of using a physical copy of the PAN card.

- Reduction in tax evasion: Income tax PAN Aadhaar link Easily help reduce tax evasion, as it makes it easier for the government to track the income and expenditure of taxpayers.

- Faster processing of refunds: The PAN Aadhaar link can help speed up the processing of tax refunds, as the government can easily match the details of taxpayers with the information available in their database.

- Access to government services: Income tax PAN Aadhaar link Easily provide access to various government services, including opening bank accounts, getting a new SIM card, and applying for various government schemes and subsidies.

In summary, the Income tax PAN Aadhaar link Easily can streamline the tax filing process, reduce tax evasion, and improve the delivery of government services to citizens.

Read Also: – 7 Best way to prepare Government jobs at Home

How to link aadhaar with pan card online step by step?

Income tax PAN Aadhaar link Easily online is a simple and straightforward process. Here are the step-by-step instructions to follow:

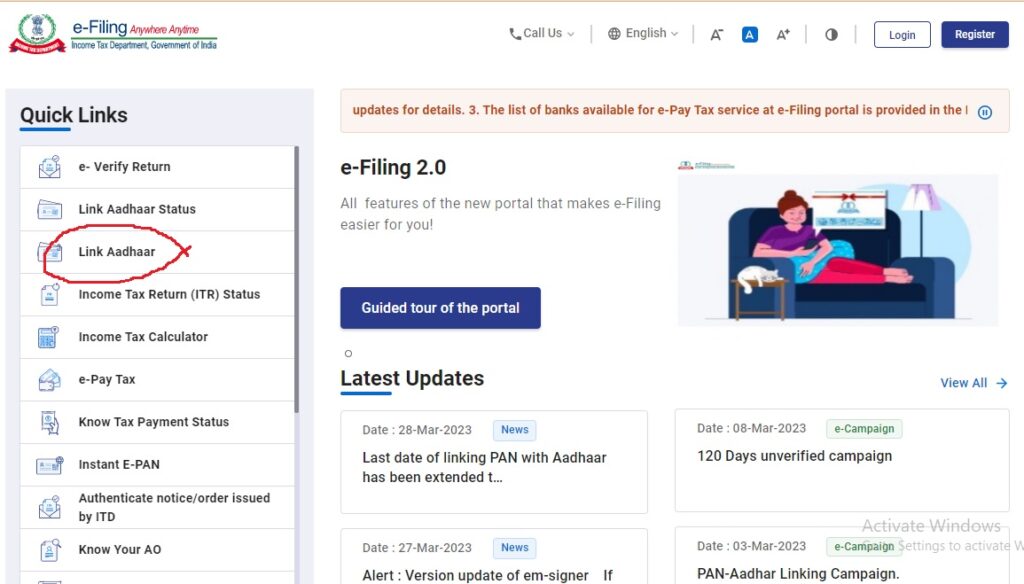

Step 1: Visit the Income Tax Department’s e-filing website at https://www.incometaxindiaefiling.gov.in/

Step 2: Click on the “Income tax PAN Aadhaar link Easily” option on the homepage.

Step 3: Enter your PAN number, Aadhaar number, name as per Aadhaar, and the Captcha code.

Step 4: Click on the “Link Aadhaar” button to proceed.

Step 5: If your details match with the Aadhaar database, your Aadhaar will be successfully linked with your PAN card.

Step 6: In case of any discrepancy, you will be prompted to make the necessary corrections before Income tax PAN Aadhaar link Easily.

Step 7: You can also check the status of the Aadhaar-PAN linking request by clicking on the “Status” option on the homepage.

It is important to note that the name and date of birth mentioned on your Aadhaar card must match with the details mentioned on your PAN card for a successful linking process. In case of any discrepancies, you may need to get them corrected before proceeding with the linking process.

PAN Aadhaar link check Status –

To check the status of the PAN Aadhaar link, you can follow these steps:

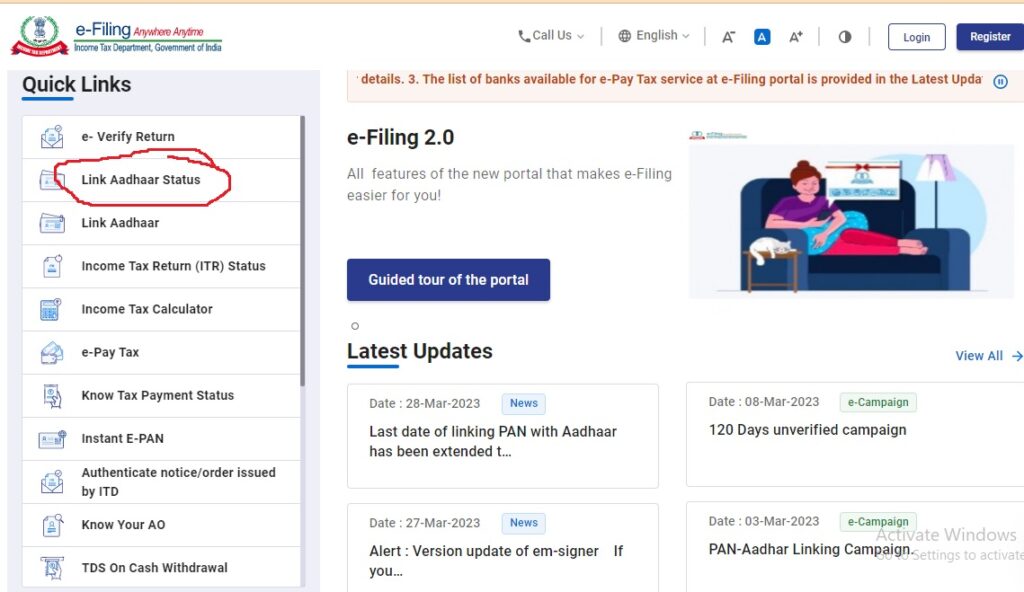

Step 1: Go to the Income Tax Department’s e-filing website at https://www.incometaxindiaefiling.gov.in/

Step 2: Click on the “Link Aadhaar” option on the homepage.

Step 3: On the Aadhaar-PAN linking page, click on the “Status” button.

Step 4: Enter your PAN and Aadhaar number and click on “View Link Aadhaar Status”.

Step 5: If your Income tax PAN Aadhaar link Easily, a message will be displayed on the screen that states “Your PAN is linked to Aadhaar Number xxxxxxxxxxxx”.

Step 6: If your Aadhaar and PAN are not linked, the status will be displayed as “Not Linked”.

Step 7: In case of any discrepancies or errors, the status will be displayed as “Failed” along with the reason for the failure.

It is advisable to regularly check the status of your PAN Aadhaar link to ensure that it is active and to avoid any issues in the future.