Axis Bank Credit Cards.

Kiwi Axis Bank UPI Credit Card: To Make UPI Payments Axis Bank is one of the leading private sector banks in India, and it offers a wide range of credit cards to cater to different customer needs. Here are some of the popular Axis Bank credit cards:

Read also –Online PDF Editor – How to Manage PDF online Documents.

- Axis Bank ACE Credit Card: Kiwi Axis Bank UPI Credit Card: To Make UPI Payments.This card is designed for frequent online shoppers and offers benefits such as accelerated reward points on online spends, discounts on dining and entertainment, and complimentary lounge access.

- Axis Bank Flipkart Credit Card: This co-branded card with Flipkart offers benefits such as reward points on every transaction, discounts on Flipkart and partner websites, and fuel surcharge waivers.

- Axis Bank Neo Credit Card: Kiwi Axis Bank UPI Credit Card: To Make UPI Payments This card is targeted towards millennials and offers benefits such as discounts on movie tickets, free home delivery from select food delivery platforms, and cashback on mobile recharge and bill payments.

- Axis Bank Vistara Credit Card: This co-branded card with Vistara offers benefits such as welcome bonus miles, complimentary lounge access, discounts on flight bookings, and reward points on every transaction.

- Axis Bank Magnus Credit Card: This premium card offers benefits such as high reward points on every transaction, complimentary lounge access, golf privileges, and concierge services.

- Axis Bank FreeCharge Credit Card: Kiwi Axis Bank UPI Credit Card: To Make UPI Payments This co-branded card with FreeCharge offers benefits such as cashback on every transaction, discounts on FreeCharge and partner websites, and fuel surcharge waivers.

These are some of the popular credit cards offered by Axis Bank. Customers can choose the card that best suits their needs and lifestyle.

KIWI Axis Bank Credit Card.

The KIWI Axis Bank Credit Card is a credit card offered by Axis Bank, Kiwi Axis Bank UPI Credit Card: To Make UPI Payments one of the leading private sector banks in India. The card is designed to provide customers with a range of benefits, including reward points on every transaction, cashback offers, discounts on dining, shopping, and other expenses, as well as exclusive deals on travel and entertainment.

Some of the key features and benefits of the KIWI Axis Bank Credit Card include:

- Reward points: Kiwi Axis Bank UPI Credit Card: To Make UPI Payments Cardholders can earn reward points on every transaction they make using their credit card. These reward points can be redeemed for a variety of products and services.

- Cashback offers: Cardholders can avail of cashback offers on their credit card purchases. The cashback amount will be credited to their account at the end of the billing cycle.

- Discounts on dining and shopping: Kiwi Axis Bank UPI Credit Card: To Make UPI Payments Cardholders can enjoy discounts and offers on dining, shopping, and other expenses. These offers are available at select merchants across India.

- Exclusive deals on travel and entertainment: Cardholders can avail of exclusive deals on travel and entertainment. These deals include discounts on air tickets, hotel bookings, and more.

- Zero liability on lost card: In case of a lost or stolen credit card, the cardholder is not liable for any unauthorized transactions made on the card.

Overall, the KIWI Axis Bank Credit Card is a good option for customers who want to enjoy a range of benefits and rewards on their credit card transactions. However, it is important to note that the card comes with certain terms and conditions, including minimum income requirements and annual fees. Prospective customers should carefully review these terms and conditions before applying for the card.

About KIWI Credit Card: –

KIWI is a Banking Credit card System That’s allow to online transactions through the Lifetime free Credit card. it has announced the launch of its all in one Credit on UPI Solutions for the Customers. Kiwi Axis Bank UPI Credit Card: To Make UPI Payments KIWI is the First app in India that’s is Certified by the NPCI, it will help to Customers Experience on Credit UPI by Issuing Rupay Card in Partnership Within Axis Banks.

KIWI launches Lifetime free Credit card aims to establish a massive a direct to consumer (D2C) Credit Market. This is also made possible through their mobile application users also make securely payments direct from their phone using a credit card & bank account. Kiwi Axis Bank UPI Credit Card: To Make UPI Payments Speaking about the launch, Siddharth mehta Co- founder of KIWI, acknowledge the widespread adoption of UPI in India over 30 crore unique Users and 5 Crore merchant Onboard. the Company aims to Target rate of enable 1 millions users to access credit on UPI within the next 18 months.

Read also -Which is the Best No.1 Printer for Home use

The launch of KIWI Kiwi Axis Bank UPI Credit Card: To Make UPI Payments app in India noticed that the first time in India users can enjoy the benefit of Rupay UPI using by this online transaction process. Kiwi Axis Bank UPI Credit Card: To Make UPI Payments New offers giving by the WIKI apps Users can obtain a Rupay credit card & it is almost instantaneously & digitally.

As once card is received it can be linked with UPI app its can enable to process of online & Offline Store transaction through the credit on UPI Feature. Kiwi Axis Bank UPI Credit Card: To Make UPI Payments The KIWI app can provides the card management options such as limit increase blocking & payments. Kiwi Axis Bank UPI Credit Card: To Make UPI Payments Each & Every transaction can rewarded making it a convenient & beneficial service of users.

Praveen rai, COO, NPCI Said that all our one motivation here to all users & customers can get benefit to here & the goal of Digital payments for all & WIKI will be a Game Changer in future references well work in Indian credit card Industry. Currently UPI P2M Transactions amount to roughly Rs. 3.2 lakh crore per month, Kiwi Axis Bank UPI Credit Card: To Make UPI Payments which is 2.5 times more than monthly credit card Spending. KIWI is set to a capitalized on a significant untapped market. looking at the White space that kiwi is addressing NPCI believes that KIWI approach will assist numerous Indian credit cards users.

According to Anup Gupta the managing director of Nexus venture partners WIKI is set to provide customers with the ultimate combinations of Credit cards & UPI. Kiwi Axis Bank UPI Credit Card: To Make UPI Payments this means that they can enjoy the all convenience towards & flexible repayments options that credit card offer. while that the benefiting from the wide acceptance of UPI across India. Gupta expressed excitement in collaborating within the KIWI teams to advanced credit card use through out the country.

Credit on UPI & Lifetime Free Axis bank RuPay Credit Card for KIWI Waitlist Users:

KIWI launches to Lifetime free Axis bank Credit card cash back of 2% for Users in the waitlist

Go to the Official Website Link-https://gokiwi.in/

Scan & Pay users get flat 2% cashback & waitlist users get flat 1% cashback.

The Wiki is Expected to be available by mid may, but users can already register and joining all the waitlist users.

Users Can make UPI Payments with KIWI Rupay Credit card.

Over the Next 18 Months, the leadership Except to android 2 million users.

Why join the KIWI Axis Credit UPI : –

To make the UPI payments to the Services with your credit card on KIWI.

Scan & pay with your Virtual Credit UPI.

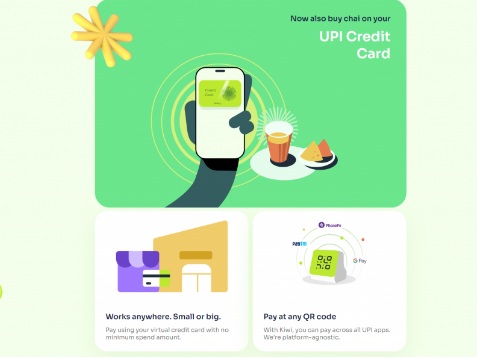

Now Credit card also Buy Chai on your UPI

Do you works Kiwi Axis Bank UPI Credit Card: To Make UPI Payments Anywhere as small or big using always your virtual Credit card within no minimum amount of spent pay at any QR code with KIWI, & you can also pay across UPI apps its platform is Suitable for it.

a. Lifetime Credit card

b. Sacn & Pay on you Virtual Credit card.

c. Our Credit card is free always will be.

d. Get it Instanty.

e. Start using your card immediately with Quick On boarding & Verification.

f. cashback on every purchase on using scan & pay card.

g. Rewards on Every transaction.

f. Rewards 2x assured.

g. Claim cashback anytime.

h. Directly Deposited in your bank account no time.

i. A Credit card works Everywhere.

j. We all Deserve Extra ordinary Benefits.

Kiwi Axis Bank Rewards Term & Conditions.

- Eligibility.

- KIWI Rewards.

- KIWI Includes the Following Programs.

- Rewards of KIWI Axis bank On boarding Quick Credit card.

- Transaction Rewards From Within Every Merchant Payments of Using KIWI Axis Bank Credit Card.

- Transaction rewards using Bank account within KIWI.

- Referral Rewards.

- Waitlist Rewards.

1. Eligibility.

Customer Will be Eligible for KIWI for their First transaction. The Transaction minimum Amount will be Multiple Rs.50/- to be Undertaken by the Customers.

2. KIWI Rewards.

it is the point that the Customers will earn will be called as KIWI’s. Kiwi Axis Bank UPI Credit Card: To Make UPI Payments The KIWI Redeemed in to their Gaaxb. UPI ID Linked with in Account Anytime. Each KIWI Will be Currently Worth RS. 0.25/-.

3. KIWI Includes the Following Programs.

- Monthly Spend Rewards.

- Rewards For On boarding for the Axis Bank KIWI Credit card.

- Transaction rewards for Every merchant Using the Payments Axis bank Credit card..

- Transaction rewards using from their bank account.

- Referral rewards

4. Rewards of KIWI Axis bank On boarding Quick Credit card.

- KIWI’s On in principle approval for the card is 200.

- KIWI’s for the completing the KYC Process for the card is 400.

- KIWI’s For completing first transaction of the card is 400.

- KIWI’s can be only Redeemed after completion of the step 3 -Completion of a transaction.

- This offer is not valid for the customers it hads been on boarded through a third party agent.

- Offer will be on sole discretion of GOKIWI and can be changed at their discretion.

5. Transaction Rewards From Within Every Merchant Payments of Using KIWI Axis Bank Credit Card.

- a. 1 Kiwi For Every Merchants Rs- 50/- Spent on the card – Kiwi re calculated on multipliers of Rs.50/- i.e

- 2 kiwi’s Earned – Transaction of Rs. 100/-

- 1 kiwi’s Earned – Transaction of Rs. 75/-

- 3 kiwi’s Earned – Transaction of Rs. 175/-

- b. 2x rewards or scan & pay transactions i.e – Customer earned 2 kiwis for every Rs. 50/- rupees Spent on the card scanning by a QR Code.

- c. Max can on rewards is 1% of the total credit of the limitation of the card.

6. Transaction rewards using Bank account within KIWI.

Customer will receive 100 kiwis for the first transaction using their bank account on the kiwi app.

7. Referral Rewards.

- a. Referrer – Is a customers who refers an Unique referral code.

- b. Referee – Is a person to Whom the Referrer refers his her unique referral code.

- c. Which will visible to them & they can share the same with Referee, Will get a Unique Referral code.

- d. Axis bank Credit card of KIWi’s shall be issued to the Referee at the Sole discretion of the bank post successful Submission of credit card application form & KYC Completion of the Referee on the kiwi App.

- e. First successful transaction made by the on the Axis bank KIWi’s Credit card by the Referee – Referrer post will get 400 kiwis.

- f. The Credit card Customers can completed the above all the transactions process mentioned within 7 days from the date of Referral code so generated. for the Referrer to be eligible for the Rewards.

Read also –Jio payments bank account opening Process.

8. Waitlist Rewards.

- The Waitlist will only apply for the users Who Sign up.

- Scan & pay Users payments with the Axis bank KIWI credit card on the Kiwi app will be Eligible for the 2% Cashback.

- For the Transactions of the rs. 50 or more on the card, the users will earn 4 Kiwi’s. Kiwi’s are calculated using multipliers of Rs.50 For example.

- Earn 4 Kiwi’s for a transaction of Rs. 50/-

- Earn 4 Kiwi’s for a transaction between of Rs. 51/- and Rs.99/-

- Earn 8 Kiwi’s for a transaction of Rs. 100/-

- Earn 8 Kiwi’s for a transaction between of Rs. 101/- and Rs.149/-

- Earn 12 Kiwi’s for a transaction of Rs. 150/-

- Rewards are Capped at 2% of the total Credit limit.

- The offer will be valid for 60 days from the date of issuing of the Axis bank Kwik Credit card.

how to apply for the kiwi axis credit card online –

To apply for the Kiwi Axis Credit Card online, you can follow these steps:

Read also – Morpho RD Service.

- Visit the official website of Axis Bank, which is the issuer of the Kiwi Axis Credit Card.

- On the homepage, click on the “Credit Cards” option.

- Look for the Kiwi Axis Credit Card among the list of available credit cards and click on the “Apply Now” button.

- You will be redirected to a new page where you will need to provide some basic personal and financial details, such as your name, contact information, income, etc.

- Fill out the application form carefully and accurately. Kiwi Axis Bank UPI Credit Card: To Make UPI Payments Make sure to read the terms and conditions before submitting your application.

- Once you have filled out the application form, click on the “Submit” button.

- After submitting the application, you will receive a confirmation message on your registered mobile number and email ID.

- Wait for the bank to process your application. If your application is approved, you will receive your Kiwi Axis Credit Card in the mail within a few days.

Kiwi Axis Bank UPI Credit Card: To Make UPI Payments Note that the eligibility criteria and required documents may vary depending on the bank’s policy. Make sure to check the requirements before applying for the credit card.