Personal Loan –

A personal loan is a type of unsecured loan offered by financial institutions, Online Apply SBI personal loan such as banks or credit unions, to individuals for various personal expenses. Here are some brief definitions related to personal loans:

- Personal Loan: A loan provided to an individual borrower for personal use, typically with a fixed repayment schedule and interest rate.

- Unsecured Loan: A loan that is not backed by collateral, such as a house or a car. Personal loans are usually unsecured, meaning the borrower does not need to provide any asset as security.

- Interest Rate: The cost of borrowing money, expressed as a percentage of the loan amount. Online Apply SBI personal loan Personal loan interest rates can be fixed (remain constant throughout the loan term) or variable (fluctuate based on market conditions).

- Loan Term: The period over which the borrower agrees to repay the loan. Personal loan terms typically range from one to seven years, but can vary depending on the lender and loan amount.

- Loan Amount: Online Apply SBI personal loan The total sum of money borrowed by an individual through a personal loan. The loan amount is determined by the borrower’s creditworthiness, income, and other factors.

- Credit Score: A numerical representation of an individual’s creditworthiness, based on their credit history and financial behavior. Lenders often consider credit scores when approving personal loan applications and determining interest rates.

- EMI (Equated Monthly Installment): Online Apply SBI personal loan The fixed monthly payment made by the borrower to repay the personal loan. The EMI includes both the principal amount and the interest accrued.

- Prequalification: The initial assessment performed by a lender to determine if a borrower is eligible for a personal loan. Prequalification typically involves a soft credit check and basic financial information.

- Debt Consolidation: A strategy where a borrower uses a personal loan to pay off multiple existing debts, Online Apply SBI personal loan such as credit cards or other loans. This allows the borrower to combine their debts into a single loan with potentially lower interest rates and simplified repayment.

- Origination Fee: A fee charged by the lender for processing a personal loan application and disbursing the funds. Online Apply SBI personal loan The origination fee is usually a percentage of the loan amount and is deducted upfront from the loan proceeds.

It’s important to note that specific terms and conditions can vary between lenders, so it’s advisable to thoroughly review the loan agreement and consult with the lender for precise details regarding a personal loan.

Personal Loan Eligibility –

To determine your personal loan eligibility, lenders typically consider several factors. While the specific criteria may vary among lenders, here are some common factors that play a role in determining your eligibility:

- Credit Score: Your credit score is a numerical representation of your creditworthiness. Lenders use it to assess the risk of lending to you. A higher credit score generally improves your chances of being eligible for a personal loan.

- Income: Lenders will typically consider your income to determine whether you have the financial means to repay the loan. A higher income can increase your eligibility for a personal loan.

- Employment History: Your employment history helps lenders gauge the stability of your income. Having a steady job or a long-term employment record can improve your eligibility.

- Debt-to-Income Ratio: Lenders assess your debt-to-income ratio, which compares your monthly debt payments to your monthly income. A lower ratio indicates a better ability to manage additional debt and can enhance your eligibility.

- Repayment History: Your track record of repaying previous loans or credit cards can influence your eligibility. If you have a history of timely payments, it demonstrates your creditworthiness to lenders.

- Collateral: Personal loans can be either secured or unsecured. Secured loans require collateral, such as a property or a vehicle, which can increase your eligibility. Unsecured loans do not require collateral but may have stricter eligibility criteria.

- Loan Amount and Tenure: The loan amount and tenure you are applying for can also impact your eligibility. Some lenders have specific minimum and maximum loan limits, and they may consider your ability to repay the loan within the chosen tenure.

Remember that each lender has its own eligibility criteria, so it’s essential to check with the specific lender you’re considering. Additionally, meeting the eligibility criteria does not guarantee approval, as lenders may consider other factors as well.

It’s advisable to compare loan offers from multiple lenders, considering their interest rates, fees, and terms, to find the most suitable loan option for your needs.

From Where to Get Personal Loan –

Personal loans can be obtained from various sources. Here are some common places where you can get a personal loan:

- Banks: Traditional banks offer personal loans and usually have specific requirements and application processes. You can visit your local bank branch or apply online.

- Credit Unions: Credit unions are member-owned financial institutions that often offer personal loans at competitive interest rates. You typically need to be a member to apply for a loan.

- Online Lenders: Online lenders have become increasingly popular for obtaining personal loans. They operate entirely online and provide a quick and convenient application process. Examples include SoFi, LendingClub, and Prosper.

- Peer-to-Peer Lending Platforms: Peer-to-peer lending platforms connect borrowers with individual lenders who are willing to lend money. These platforms often have different eligibility criteria and interest rates. Examples include Peerform and Upstart.

- Financial Technology (FinTech) Companies: Some FinTech companies provide personal loans with innovative features and streamlined processes. Examples include Avant and Earnest.

- Credit Card Companies: Credit card companies may offer personal loans to their customers. These loans may be in the form of cash advances or installment loans, and they typically have higher interest rates compared to traditional personal loans.

Read also –HDFC Bank Zero Balance Account Opening

When choosing a source for your personal loan, consider factors such as interest rates, repayment terms, fees, eligibility criteria, and customer reviews. Online Apply SBI personal loan It’s essential to compare options and select the one that best suits your needs and offers favorable terms.

SBI Personal Loan –

State Bank of India (SBI) offers personal loans to eligible individuals to meet their financial needs. Here are some key details about SBI personal loans:

- Eligibility: SBI personal loans are available to salaried employees, self-employed professionals, and individuals with a regular source of income. The eligibility criteria may vary, Online Apply SBI personal loan so it’s advisable to check with SBI or visit their official website for the most up-to-date information.

- Loan Amount: The loan amount offered by SBI for personal loans can range from a minimum of Rs. 25,000 to a maximum of Rs. 20 lakhs, Online Apply SBI personal loan depending on various factors such as income, creditworthiness, repayment capacity, and other criteria set by the bank.

- Interest Rate: The interest rates for SBI personal loans are generally competitive and depend on factors such as the loan amount, tenure, and applicant’s credit profile. Online Apply SBI personal loan The interest rates can be fixed or floating, and the bank may also offer special interest rates for existing customers or for specific categories of borrowers.

- Repayment Tenure: SBI personal loans come with flexible repayment options. The tenure can range from a minimum of 12 months to a maximum of 60 months, Online Apply SBI personal loan allowing borrowers to choose a repayment period that suits their financial situation.

- Processing Fees: SBI charges a processing fee for personal loans, which is a percentage of the loan amount. The exact fee may vary, Online Apply SBI personal loan and it’s advisable to check with the bank for the latest charges.

- Documentation: Applicants are required to submit certain documents when applying for an SBI personal loan. The documents typically include proof of identity, Online Apply SBI personal loan address proof, income proof, bank statements, and other relevant documents as per the bank’s requirements.

- Application Process: Interested individuals can apply for an SBI personal loan by visiting the nearest SBI branch or by applying online through the SBI official website. Online Apply SBI personal loan The online application process is usually straightforward and allows applicants to submit their details and upload the required documents.

The specific terms, conditions, and eligibility criteria may have changed or may vary based on the bank’s policies and guidelines at the time of your application. Therefore, Online Apply SBI personal loan it’s always recommended to directly contact SBI or visit their official website for the most accurate and up-to-date information regarding personal loans.

Features of SBI Personal Loan –

- Low Processing Fees.

- No hidden Costs

- Quick Loan Processing

- Easy EMIs through SI

- Minimal Documentation

- You can Apply at All SBI Branches

Eligibility –

For central & State Governments Prisoners’ –

- The Prisoners Should be Below 76 Years of age.

- Pension Payments Documents is Mention is Mandatory.

- To Prisoners have Complete their Irrevocable Undertaking not to amend his mandate to the Treasury during the tenure of the loans.

- The Treasury Amount Give to Consent in Writing that Will not accept any request from the pension holder transfer his payment to any other bank till a NOC is Issued.

- All of the Above Terms & Conditions of the Scheme will be applicable. Including Guarantee by the Loan Seeker ( Eligible for Family Pension or by a Suitable Third Party.

For Defense Prisoners’ –

- Pensioners from Armed Forces, Including Army , Navy & Air force, Paramilitary Forces ( CRPF, CISF, BSF, ITBP etc) Coast Guards Rastriya a Rifles & Assam Rifles.

- The Pensioners pension payment is Mentioned within SBI.

- No minimum age instructions is under the Schemes.

- The Maximum age bar at the Time of Processing the Loan Should be less than 76 years.

For Family Prisoners’ –

- The Family Pensioners include authorized members of the family to receive pension after the Death of the Pensioners.

- Should not be more than 76 years of age to the Family pensioners.

Loan Amount & Repayments (SBI Pension Loans) –

- SBI Pension Loan Repayments Period – ( 72 months – Loan to be repayment by 78 years of age)

- JAI Jawan Pension – Loan Maximum at the age of time sanctioned up to 76 years. Maximum repayments period 72 months. Age at the time of full repayments in 78 years.

- SBI Pension Loan Scheme to Pensioners of PSUs – ( 72 months – Loan to be repayment by 78 years of age)

- INSTA Pension Loan Scheme through YONO – Repayment Period the Demand Loans Can be repayable by EMIs Through Standing instructions. The maximum repayment period will be 3 years.

SBI Xpress Flexi Personal Loan –

Xpress Flexi Online Apply SBI personal loan Personal Loan is a type of personal loan offered by certain financial institutions or lenders. While I don’t have information about specific loan products beyond my knowledge cutoff date in September 2021, I can provide a general understanding of what a flexi personal loan typically entails.

A flexi personal loan is designed to provide borrowers with greater flexibility in Online Apply SBI personal loan managing their loan repayment. Here are some common features you might find in a flexi personal loan:

- Variable Loan Amount: With a flexi personal loan, you may have the option to borrow varying loan amounts, depending on your financial needs and eligibility. Online Apply SBI personal loan This allows you to access funds as and when required, up to a pre-approved credit limit.

- Withdrawals and Repayments: Flexibility is offered in terms of withdrawals and repayments. Online Apply SBI personal loan You can make multiple withdrawals from your approved credit limit whenever you need funds. You will only be charged interest on the amount you have withdrawn and for the duration it remains outstanding. Additionally, you can make repayments in parts or in full without any prepayment penalties.

- Interest Charges: Online Apply SBI personal loan Interest is typically charged only on the amount you have withdrawn and for the duration it remains outstanding. This feature can potentially help you save on interest costs if you repay the borrowed amount quickly.

- Tenure and EMI: Flexi personal loans generally have a predetermined loan tenure. Online Apply SBI personal loan The monthly Equated Monthly Installment (EMI) is calculated based on the outstanding balance. As you make repayments, the outstanding balance decreases, which may reduce the subsequent EMIs.

- Accessibility: Some flexi personal loan products may offer features such as a dedicated credit line, Online Apply SBI personal loan checkbook, or online access for convenient and quick access to funds.

Read also –Home Loan Apply Online

It’s important to note that the specific terms and conditions of a flexi personal loan, including interest rates, Online Apply SBI personal loan repayment tenure, and eligibility criteria, may vary between lenders. Therefore, it is recommended to contact the lender directly or visit their website to get the most accurate and up-to-date information regarding the Xpress Flexi Personal Loan or any similar loan product they offer.

SBI Xpress Credit Personal Loan –

SBI Xpress Credit Personal Loan is a type of personal loan offered by the State Bank of India (SBI), Online Apply SBI personal loan one of the largest banks in India. It is designed to provide quick access to funds for various personal financial needs, such as medical expenses, travel, education, Online Apply SBI personal loan wedding, or any other genuine personal expenses.

Read also – SBI Personal Loan

Here are some key features of SBI Xpress Credit Personal Loan:

- Loan Amount: The loan amount can range from a minimum of Rs. 25,000 up to a maximum of Rs. 20 lakhs, depending on various factors such as income, Online Apply SBI personal loan credit history, and repayment capacity.

- Quick Approval: SBI aims to provide quick approval and disbursal of the loan amount to eligible applicants.

- Minimal Documentation: The loan application process involves minimal documentation, making it convenient for borrowers.

- Repayment Tenure: The repayment tenure for SBI Xpress Credit Personal Loan can be up to 60 months (5 years). Borrowers can choose a suitable repayment period based on their financial capabilities.

- Interest Rates: The interest rates for SBI Xpress Credit Personal Loan are typically competitive, Online Apply SBI personal loan varying based on the prevailing market rates, the borrower’s credit profile, and other factors.

- Eligibility Criteria: The eligibility criteria for this loan may include factors such as age, income, employment stability, credit history, and other requirements specified by the bank.

- Prepayment and Foreclosure: SBI may allow prepayment or foreclosure of the loan, subject to certain terms and conditions. It is advisable to check the specific terms related to prepayment or foreclosure before availing the loan.

Loan terms and conditions, eligibility criteria, and interest rates may be subject to change over time. To get the most accurate and up-to-date information, Online Apply SBI personal loan I recommend visiting the official website of State Bank of India or contacting their customer service directly.

SBI Pre-approved Personal Loan –

SBI (State Bank of India) is one of the largest banks in India and offers various financial products and services, including personal loans. Online Apply SBI personal loan A pre-approved personal loan is a type of loan where the bank evaluates your creditworthiness based on your financial history and offers you a loan without you having to apply for it explicitly.

If you have received a pre-approved personal loan offer from SBI, Online Apply SBI personal loan it means that the bank has reviewed your credit profile and determined that you meet certain criteria to be eligible for a loan. The loan amount, interest rate, and other terms and conditions will be specified in the offer.

Here are a few key points to understand about SBI’s pre-approved personal loans:

- Eligibility: SBI will assess your creditworthiness based on various factors such as your credit score, income level, repayment history, and relationship with the bank. If you meet their criteria, you may receive a pre-approved offer.

- Loan Amount: The loan amount will depend on your financial profile and the bank’s evaluation. The offer will specify the maximum loan amount you are eligible for.

- Interest Rate: Online Apply SBI personal loan The interest rate for pre-approved personal loans may vary depending on your creditworthiness. SBI may offer competitive interest rates based on your financial history.

- Processing Time: Since it is a pre-approved loan, the processing time may be relatively shorter compared to regular personal loans. However, you will still need to complete the necessary documentation and verification processes.

- Terms and Conditions: It is essential to carefully review the terms and conditions of the pre-approved loan offer. Understand the repayment tenure, any associated fees or charges, and other terms before accepting the loan.

- Acceptance and Disbursement: If you decide to accept the pre-approved loan offer, you will need to follow the bank’s instructions for acceptance. Once accepted, the loan amount will be disbursed to your designated bank account.

Remember to compare the terms of the pre-approved loan offer with other available options in the market. While pre-approved loans can be convenient, it’s crucial to assess whether the terms suit your financial needs and goals.

To obtain specific details about the pre-approved personal loan offer from SBI, it is recommended to directly contact the bank’s customer service or visit the nearest SBI branch. They will provide you with accurate and up-to-date information based on your specific situation.

Terms &Conditions –

- EMI/NMP ratio shall not be exceed 33% in the cases for Family pensioners.

- EMI/NMP ratio shall not be exceed 50% in all other types of Pensioners.

- 3% on Prepaid Amount in Repayment Charges.

- Under the Same schemes No repayment /foreclosure charges if the account is closed from the proceeds of a new loan account.

- Repayment mode of the loan is furnished by Standing instruction to debit the pension account for Recovery of the EMIs.

- Guarantee of Loan is Secured by TPG of Spouse eligible for family pension or any other family member or a third party eligible for a loan.

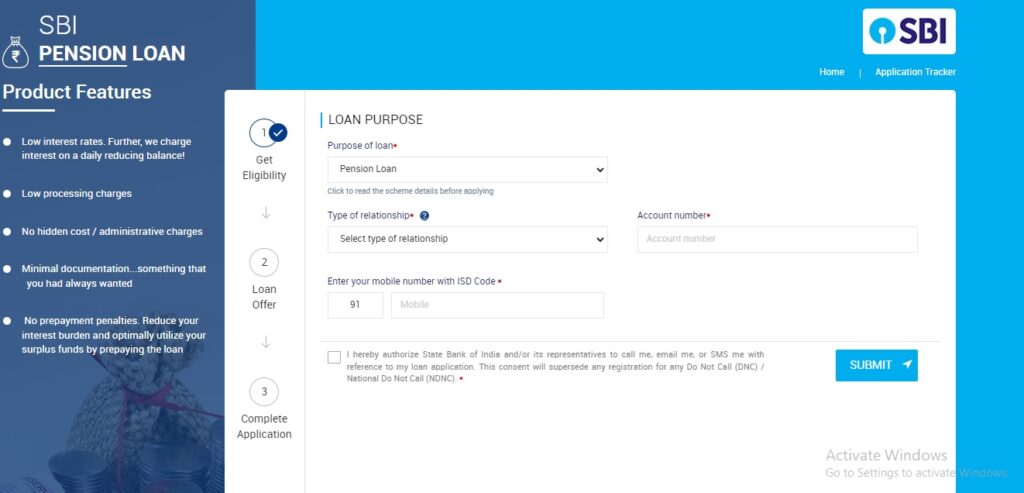

Online Apply SBI personal loan –

To apply for an SBI (State Bank of India) personal loan online, you can follow the steps outlined below:

- Visit the official website of SBI (https://www.sbi.co.in/) or navigate to the SBI loan application portal.

- Look for the “Personal Loan” section or search for “Personal Loan” in the search bar on the website.

- Click on the “Apply Now” or “Online Application” button for personal loans.

- You will be redirected to the personal loan application page.

- Fill in the required information accurately in the online application form. This information may include your name, contact details, employment details, income details, loan amount required, and any other information requested.

- Double-check all the entered information to ensure accuracy and completeness.

- Upload any necessary documents as per the requirements specified on the application form. These documents may include identity proof, address proof, income proof, bank statements, and other supporting documents.

- Review the terms and conditions, loan features, and interest rates provided by SBI for personal loans.

- Once you have reviewed and confirmed all the details, submit your application.

- After submitting the application, you will receive an application reference number or acknowledgment for future correspondence.

- SBI will process your loan application and assess your eligibility based on the information provided and their internal policies.

- If your application is approved, an SBI representative will contact you to guide you through the next steps, including document verification and loan disbursement.

Please note that the exact process may vary slightly based on the current procedures implemented by SBI. It is advisable to visit the official SBI website or contact the bank directly for the most up-to-date and accurate information regarding their personal loan application process.

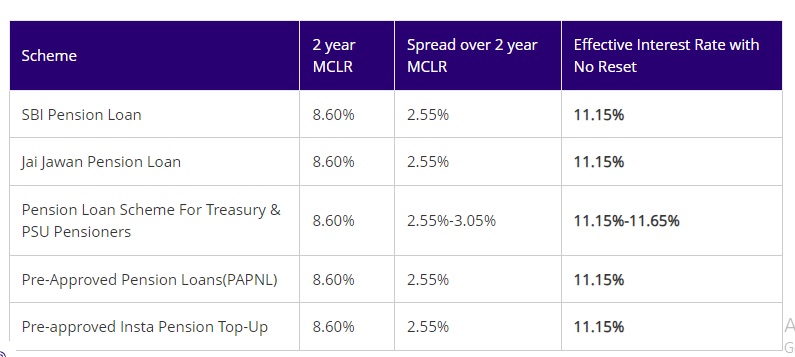

Personal Loan Interest Rate SBI –

Pensions Loans Schemes –

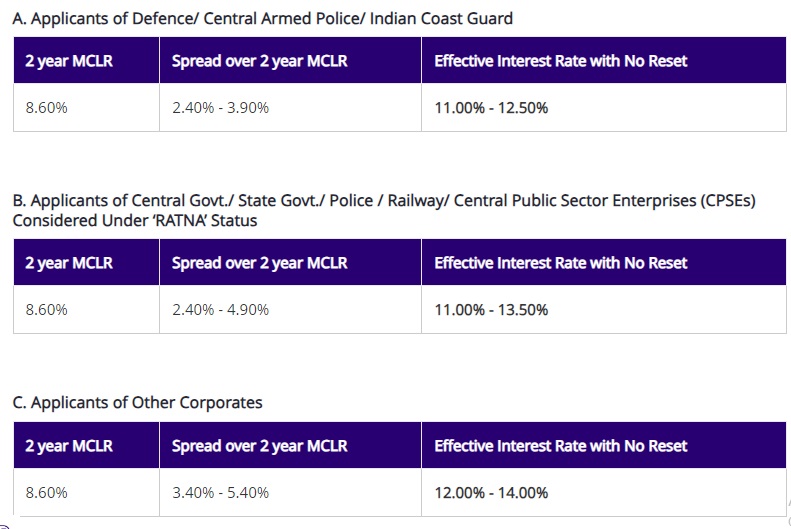

Express Elite Loan –

Express Credit Loan –

Personal Loan Online Apply Without Income prove –

Applying for a personal loan without income proof can be challenging, as most lenders require proof of income to assess your repayment capacity. Income proof helps lenders determine whether you can repay the loan amount and whether you meet their eligibility criteria. However, if you don’t have traditional income proof documents, there are a few alternatives you can explore:

- Collateral-based loans: Some lenders offer loans where you can use collateral, such as property, vehicles, or investments, to secure the loan. In this case, your income may be less relevant as the lender can rely on the collateral if you default on payments.

- Joint applicant or co-signer: If you have a trusted friend or family member with a stable income, they can act as a co-applicant or co-signer on the loan. Their income and creditworthiness may help strengthen your loan application.

- Online lending platforms: Certain online lenders may have more flexible requirements compared to traditional banks. They might consider alternative factors for evaluating your creditworthiness, such as your educational background, employment history, or future income prospects. Keep in mind that these lenders may charge higher interest rates or have stricter terms due to the increased risk.

- Peer-to-peer lending: Peer-to-peer lending platforms connect borrowers directly with individual lenders who are willing to lend money. These platforms might have different eligibility criteria and may consider other factors beyond traditional income proof.

Remember, while these alternatives exist, they might come with higher interest rates, stricter terms, or additional requirements. It’s essential to carefully evaluate your financial situation and consider the implications before applying for any loan. Additionally, reaching out to various lenders and discussing your situation can help you understand the options available to you.